Vendor Setup and Maintenance

A valid vendor record must be created in the university's vendor database before the university can pay a vendor.

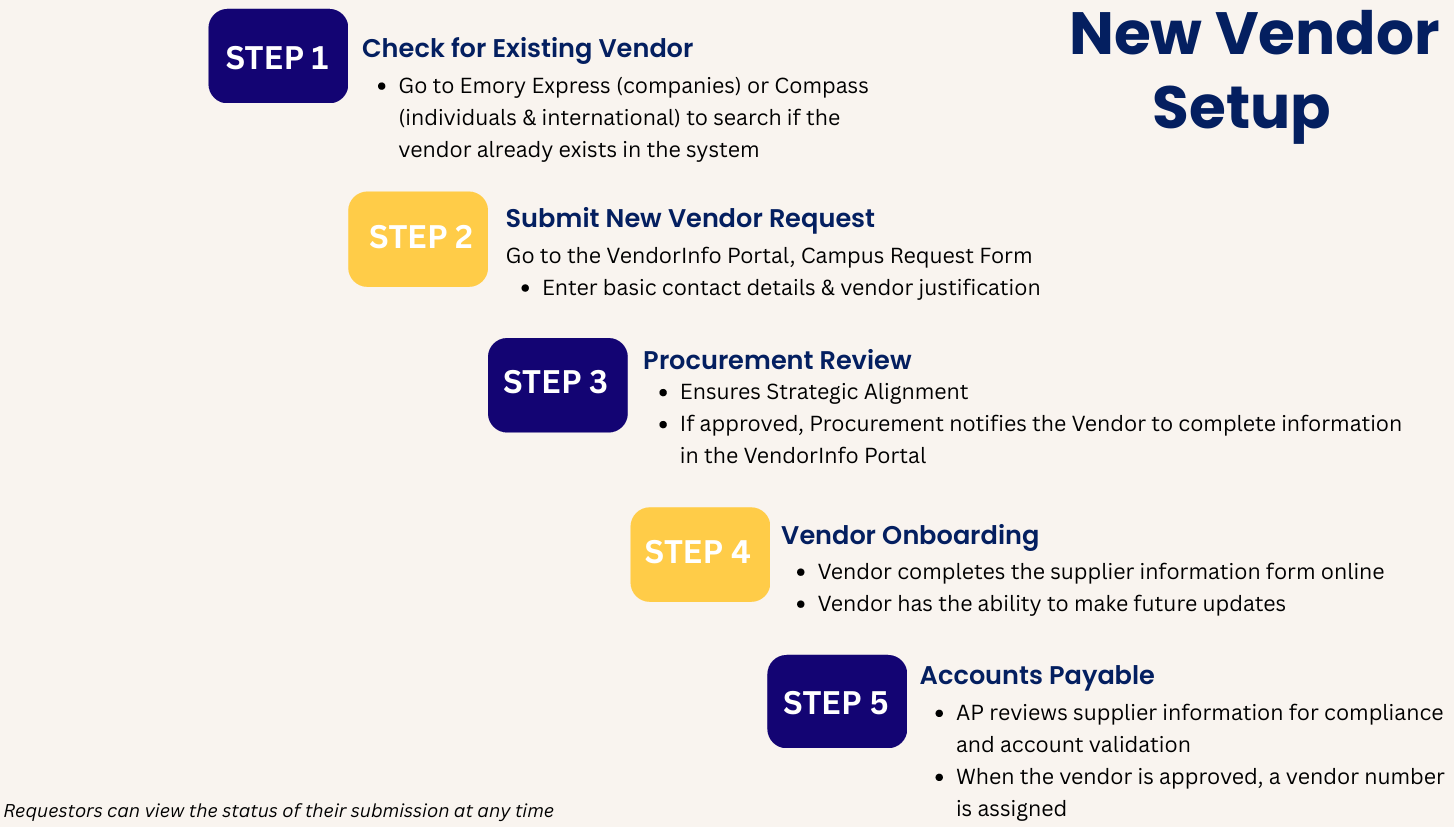

Vendor Setup

Requesting a new supplier is as simple as logging into the Vendor portal and submitting basic contact information. From there, vendors will complete their own onboarding and maintain their profiles through self-service features.

Vendor Maintenance

Modifying the vendor’s information follows a similar process.

A Vendor's record may be modified due to any of the following:

- Address Changes (new or additional supplier locations/addresses)

- Payment Changes (switching payment methods, e.g., check to ACH

- Banking Changes (different bank account or routing number)

- Name Changes (due to mergers/marriage/dba, etc.)

- Contact Changes (add or change contact phone numbers, email addresses, etc.)

Supplier Information Form (SIF) or IRS W-9 Form (Domestic)

A Supplier Individual Information form (SIF) is the preferred form for vendor set ups which includes supplier's name, address, Tax Identification Number (TIN) and type of organization for tax reportable payments.

(Note: If the supplier does not complete the SIF, the IRS requires that the university withhold and remit Backup Withholding tax to the IRS.)

IRS W-8-BEN or IRS W-8-BENE (International)

For international vendors, the W-8BEN or W-BENE is used in lieu of Form W-9.

Once a request is submitted:

When Accounts Payable sets up a vendor in the vendor database, the following compliance and validation test are completed:

TIN Matching is a process whereby the 1099 filer can check the Tax Identification Number (TIN) with a specific name to ensure that there is a match in the IRS database. This process helps filers avoid IRS penalties and B-Notices for missing TINS or incorrect Name/TIN combinations. In addition, it provides fraud prevention since the matching process ensures suppliers are "legitimate". If the combination does not match, Accounts Payable will reach out to the department and ask that they contact the vendor to have them resubmit their SIF or W-9 form with the correct TIN.

Compliance screening is a key component of supplier validation. It ensures compliance with OFAC (Office of Foreign Asset Control) and other regulatory requirements. It also helps to avoid penalties due to non-compliance.

If the supplier elects to get paid via ACH, the ACH information is validated to ensure that the funds are disbursed to the correct supplier bank account.

The US Federal Government developed this software which maintains a list of federally registered suppliers and their status with the federal government. SAM is used as part of the supplier verification process to verify that funds are only being sent to federally approved Suppliers.