Expense Reimbursement

Emory reimburses employees, students, and Emory guests for necessary and reasonable approved expenses they incur in the conduct of university business. Reimbursements are processed through Accounts Payable and will either be directly deposited into the primary bank account identified by the employee/payee or paid by check.

Travel Reimbursements – To reimburse employees traveling on university business.

An Expense Report needs to be created and submitted through the university's travel and expenses system.

Out-of-Pocket Reimbursements – To reimburse faculty, staff, students, or university guests who incur out of pocket University expenses.

- For Employees – Create an Expense Report

- For Students or University Guests, create a Payment Request and submit via Compass.

Please refer to the Disbursement Policy (2.128) for more information.

Expense Reimbursement Overview

All university expenses must be necessary and reasonable in terms of price and purpose. Therefore, each university reimbursement must be supported by a written business purpose, regardless of the item, type of service, amount or form of payment.

Additionally, names of the individuals who benefited from the transaction must be included on the expense reimbursement, regardless of source of funds, venue location (on or off campus), and form of payment used. In lieu of individual names for groups larger than ten, the approximate number of people, and the group's identity, along with the business purpose, may be accepted.

The university requires receipts to be used to substantiate business expenses. For un-restricted accounts a receipt is required:

- When a single expense is $75 or more; or

- For a hotel expense of any amount.

Sponsored project accounts receipts are required for all amounts when commercially available.

When a receipt is required and cannot be obtained or has been lost, a Missing Receipt Declaration must be completed and signed by the individual who incurred the expense.

The university follows IRS “Accountable Plan” expense reimbursement guidelines, which allows the university to reimburse business expenses without including the payment amount in the taxable income of the individual incurring the expense. To be non-taxable, business expenses must be:

- Properly substantiated (see substantiating business expenses section above) and

- Submitted within certain time limitations.

To comply with IRS guidelines regarding timely submission:

- Travel related expense reimbursements are treated as a non-taxable reimbursement when submitted within 60 calendar days of the trip return date and all other requirements of the university's business expense policies are met.

- Non-travel related expense reimbursements are treated as a non-taxable reimbursement when submitted within 60 calendar days of the transaction date and all other requirements of the university's business expense policies are met.

- Pursuant to IRS guidelines, expense reimbursements are generally treated as a taxable reimbursement when reimbursements are submitted more than 60 days after the transaction date or the trip return date.

Submission of an Expense Report

- Expense reports must be submitted for all Emory Corporate Card charges. Expense reports should be submitted no later than ten days after a charge.

- Best Practice: Weekly reconciliation

- Required: Monthly reconciliation

- Pre-trip travel related purchases (airfare, conference registrations, etc.) made on an Emory Corporate Card should be submitted on an expense report prior to travel.

- To avoid a past due balance on the Emory Corporate Card, Cardholders should not wait to submit airfare or other trip expenses.

- Submitters should read and comply with Emory’s Fiscal Transactional Roles and Responsibilities policy. (2.114)

The process for reconciling a transaction is as follows:

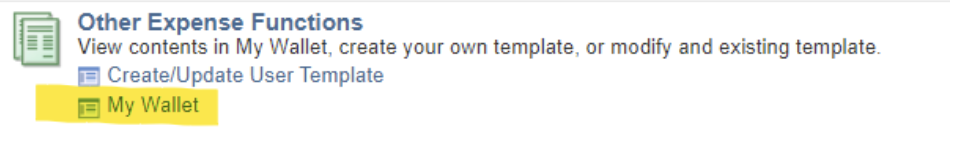

- Transactions are automatically loaded into My Wallet, which is a module in Compass’ Travel and Expense Center.

- Cardholders or their proxy prepare an expense report in the Travel and Expense Center, pulling the transactions into the expense report from My Wallet.

- Receipts need to be electronically attached.

- In the event the traveler cannot obtain a receipt, a detailed explanation of why a receipt is not available must be provided, including the date, place, amount, and explicit business purpose of each expense.

- If a proxy prepared the expense report and submitted it on the cardholder’s behalf, the cardholder will need to approve their expense report first in Compass.

- The expense report will then be routed to the supervisor for approval.

- Approvers are responsible for expense reports within two business days.

- The cardholder's supervisor should verify that the purchase was appropriate and adhered to purchasing policies. Accounts Payable should be notified if inappropriate purchases are identified.

- Approvers should read and comply with Emory's Fiscal Transactional Roles and Responsibilities policy. (2.114)

Items to Note:

- Payments to individuals or entities for services performed are not to be made directly by employees. Such payments must be made directly by the University using university payment procedures.

- Mileage reimbursement for local use of a personal automobile on university business is a reimbursable expense that will be paid at a rate in accordance with IRS guidelines.

- If an unauthorized charge (personal charge against policy etc.) is made on the card, it must be filed as a non-Reimbursable expense and paid directly to JP Morgan. Proof of payment must be attached to the expense report. Accidental personal use of the card should be immediately reported to the Business Manager/Expense report approver.

Expense Reimbursement Job Aids

Use the following links to be taken to Job Aids that will walk you through each of the following processes:

- How Do I Create an Expense Report?

- How Do I Withdraw an Expense Report?

- How Do I Determine Why My Compass Transaction Was Denied or Sent Back?

- How Do I Create an Expense Report User Template?

- How Do I Authorize Users to Manage My Expense Reports?

- How Do I Split an Expense Receipts?

- How Do I Itemize a Hotel Bill?

- How Do I Add Attendees to an Expense Report?

- How Do I View the Expense Report Summary?

- How Do I Manage Corporate Card Late Fees?

- How Do I View My Wallet Items for My Proxies?

- How Do I View Assigned My Wallet Transactions?

- How Do I Reconcile a Cash Advance?

- How Do I Check the Status of an Expense Report?

- How Do I View Expense Reports Charged to My Department?

- How Do I View Expense Reports for My Employees?